Active Development

Opportunities

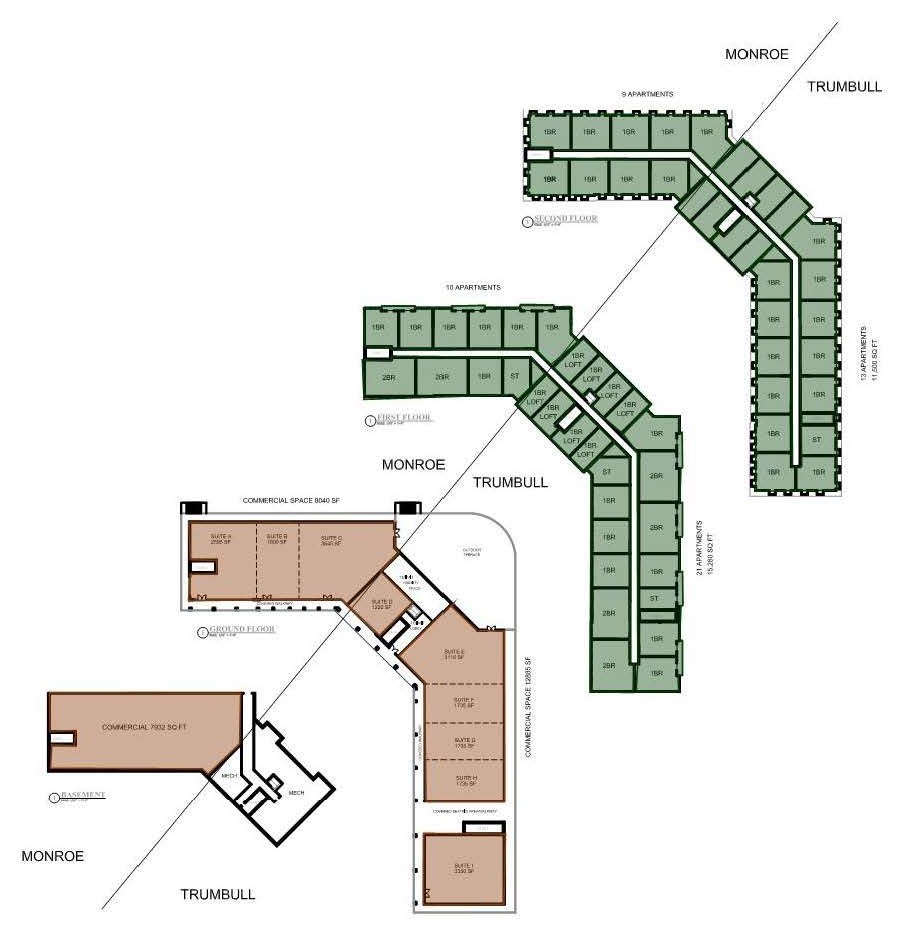

New England Coastal is actively advancing new multifamily and mixed-use developments across Fairfield County, projects designed to meet housing demand while delivering stable, tax-efficient returns for investors.

Each project follows our integrated model, from acquisition through construction and stabilization, ensuring cost control, municipal partnership, and disciplined execution.

Current Offering Snapshot

Asset Class

Class-A Multifamily/Mixed-Use Development

Location

Fairfield County, CT

Status

Entitlement &

Pre-Construction Phase

Hold Period

5 years

Target IRR

20%+

Municipal Backing

Cooperative support, grants, and local incentive programs

Why Invest with New England Coastal

Experienced Connecticut Operators: Deep market knowledge and execution track record across multiple regional projects

Vertical Integration: In-house control of acquisition, entitlement, construction, and asset management

Municipal Alignment: Trusted partnerships with local officials to streamline approvals and access grants

Disciplined Structure: Investor-first design, transparent reporting, and predictable project timelines

Tax Efficiency: Enhanced depreciation and cost segregation opportunities

Schedule a call with our team today to learn how disciplined, Connecticut-based development can help you diversify and grow your portfolio.

Emily S.

Accredited Investor

Investing in this project was one of the easiest decisions I’ve made. The projections were clear, the risks were explained upfront, and the team kept me updated at every milestone. I felt confident knowing exactly where my capital was going and how it would grow.

IMPORTANT MESSAGE: This website is a website owned and operated by (“Us/We/Our/Company”). By accessing the website and any pages thereof, you agree to be bound by the Terms of Service, Privacy Policy , and Disclosures, as each may be amended from time to time. We are not a registered broker, dealer, investment advisor, investment manager or registered funding portal. Prospective investors are advised to carefully review Our private placement memorandum, operating agreement and/or partnership agreement, and subscription documents (“Offering Documents”) and to consult their legal, financial and tax advisors prior to considering any investment in the Company, one of its subsidiaries or affiliates. Sales of any securities will only be completed through the Company’s Offering Documents and will on be made available to “Accredited Investors” as defined by the Securities and Exchange Commission (“SEC”). Generally, an Accredited Investor is a natural person with a net worth of over $1 million (exclusive of residence) or income in excess of $200,000 individually or $300,000 jointly with a spouse. The securities are offered in reliance on an exemption from the registration requirements of the Securities Act of 1933, as amended, and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. Neither the SEC nor any state regulator has reviewed the merits of or given its approval to the securities, the terms of the offerings, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities. All forward-looking statements address matters that involve risks and uncertainties and investors should be able to bear the loss of their entire investment. All investors should make their own determination of whether or not to make any investment, based on their own independent evaluation and analysis. Past performance is not indicative of future returns or Fund results. Individual investment performance, examples provided and/or case studies are not indicative of overall returns of the Company. In addition, there can be no guarantee of deal flow in the future. Forward looking statements are not statements of historical fact and reflect the Company’s views and assumptions regarding future events and performance.

All Rights Reserved New England Coastal 2026